We are proud to be the largest Class I Super Grade Co-operative Rural Bank in Kerala, dedicated to empowering communities through inclusive, people-focused banking. With a robust network of 24 branches across our operating region, we serve thousands of members with integrity, transparency, and modern financial services.

Our bank holds a strong financial foundation, with a share capital of ₹18.7 crores, deposits totaling ₹1236.76 crores, and working capital of ₹1242.20 crores. We are supported by a vibrant membership base of 67,309 A-Class members, and a total of 2,52,295 members across A, B, C, and D classes.

Read More

Deposit Schemes

Deposit SchemesSecure and rewarding investment options — including Fixed Deposits, Recurring Deposits, and Savings Plans for all age groups.

Loan Facilities

Loan FacilitiesEmpowering your dreams with a wide range of loans — personal, business, housing, and agricultural loans tailored to your needs.

Farmers’ Support Services

Farmers’ Support ServicesEmpowering your dreams with a wide range of loans — personal, business, housing, and agricultural loans tailored to your needs.

Digital Banking

Digital BankingBanking made simple with our digital solutions — mobile banking, internet banking, and SMS alerts at your fingertips.

Customer Support

Customer SupportAlways here for you — friendly, professional service with a personal touch to ensure a smooth experience.

Daily Savings Schemes

Daily Savings SchemesFlexible daily savings options collected right from your doorstep — ideal for small traders, vendors, and households.

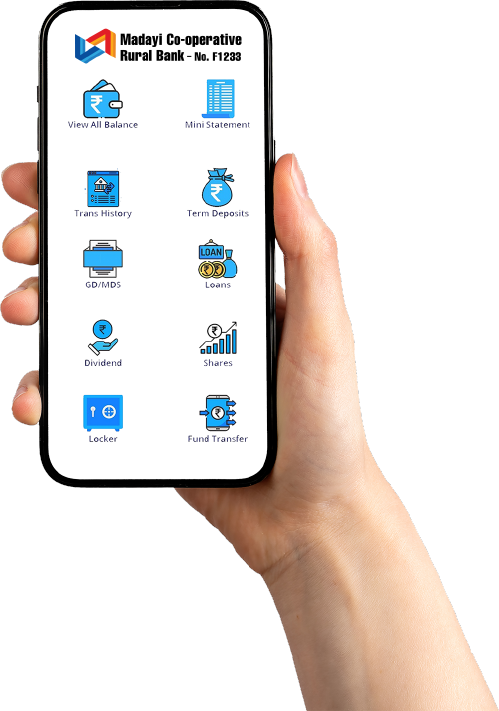

Access balances, transfer funds, apply for loans, and more — all in one simple dashboard.

A user-friendly app that lets you manage all your accounts safely from anywhere, anytime.

| Period of Deposit | Individuals & Institutions | Senior Citizen |

|---|---|---|

| 15 Days to 45 Days | 6.25% | 6.75% |

| 46 Days to 90 Days | 6.75% | 7.25% |

| 91 Days to 179 Days | 7.25% | 7.75% |

| 180 Days to 364 Days | 7.75% | 8.25% |

| 365 Days to 729 Days | 8.00% | 8.50% |

| 730 Days to 20 Years | 8.00% | 8.50% |

To be a trusted cooperative bank that drives inclusive growth and financial empowerment in rural communities. Through innovation, integrity, and a commitment to social welfare, we strive to build a self-reliant and prosperous society rooted in cooperative values.

To deliver accessible and reliable banking services that empower individuals, support rural development, and promote financial inclusion — all while upholding cooperative values, embracing technology, and contributing to the social and economic well-being of our community.

Our community-focused establishments, including the Madai Bank Auditorium, Medical Store, and MCRB Surgical, serve local needs with care and quality.

View All Services